Mastering longevity: Financial planning strategies for your health and your wealth

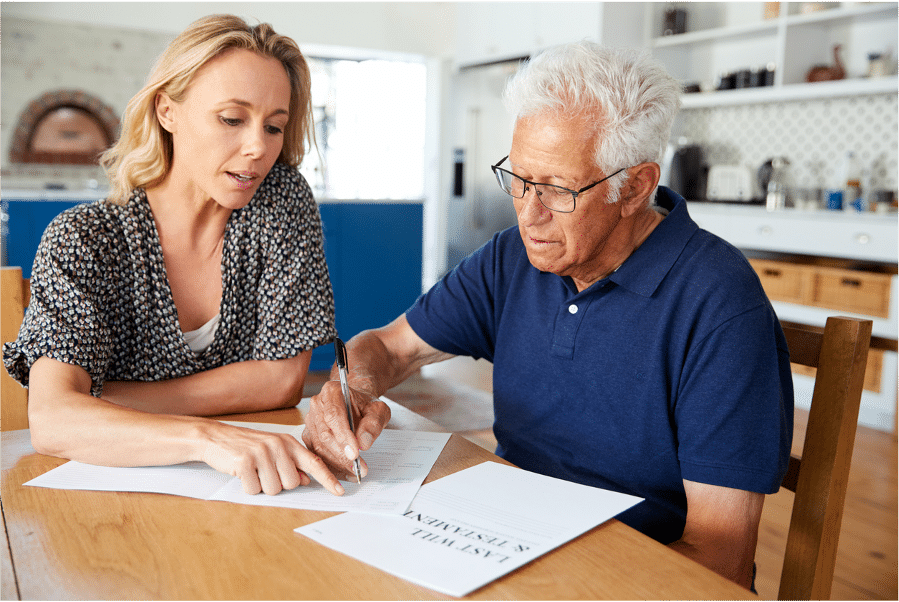

The so-called “sandwich generation” is squished between their aging parents and adult children, like a piece of lettuce. That’s how some are now referring to Gen Xers (born roughly between 1965 and 1980). Between work demands, running a home, and responsibilities to both your parents and your children, midlife is often a time of [Read More]