Money and happiness: a multi-dimensional look at how finances and positive emotion interact

We’re all aware of the phrase “money can’t buy happiness.” But how much weight does it really hold? After all, our finances play a pivotal role in how we’re able to provide for ourselves, our families, and our communities.

Money clearly doesn’t solve every problem. Many of our relationships are priceless. And no matter how much money you have, you can never buy more time. So it’s critical that we strike the right balance between money and our life’s other values.

In this article we’re going to examine how money and happiness interact through a multitude of factors. By understanding how the two are linked, you’ll be able to make more informed decisions regarding both your finances and emotional well-being.

Age, financial happiness, and the U-bend of life

It’s no mystery that one of the strongest indicators of one’s wealth is age. The reality is, most people have to work across a large part of their lifetime to afford a comfortable retirement. But if money could buy happiness, would that be such a bad thing?

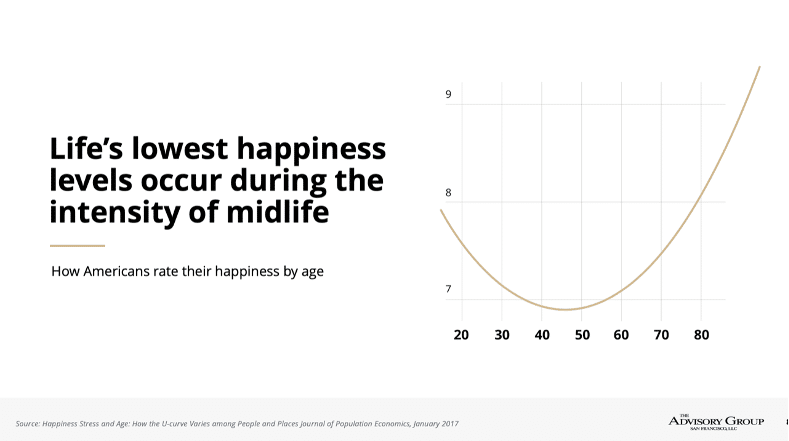

If that were the case, we’d expect the correlation between money and happiness to increase linearly over time. That is, every year someone’s bank account grows, so would their own self-reported level of happiness. But is that what happens? The U-Bend of Life tells us no.

As you can see from the graph above, self-reported levels of happiness take a “U” shape over the course of many American lives. On average, the emotion declines from a high in adolescence until it hits a low at the age of 46.

Around this low-point, people are at peak busyness, and feel more pressure than ever between their time and money. They’re sandwiched between taking care of their parents and raising and preparing children to launch. And they’re feeling the weight of readying for retirement while knowing there are still many years of work ahead. It’s clear as we age, money is only part of the equation in our happiness.

Lifestyle expectations and happiness

What if there were an actual equation for happiness? At its face, the idea might sound ridiculous. But if you knew it was formulated by a former Chief Business Officer at Google X, you might feel a bit more inclined to check it out.

In Mo Gawdat’s self-help book entitled Solve for Happy, he implores readers to take a more hands on approach to their emotions. Mo suggests that people can actually engineer their own happiness by following a simple equation:

HAPPINESS ≥ Your PERCEPTION of your Life’s Events – Your EXPECTATIONS of how life should behave.

This insightful formula applies directly to how we feel about our finances, especially in terms of investing. Do we see a market downturn as permanent? Or is it a natural event that happens over the course of following a long-term plan? Do we expect a 12% annual return every year? Or do we expect investments to fluctuate in how they perform against historical averages?

What Mo posits is that we have direct control over shaping our own perceptions and expectations in life. And as investors, our perceptions and expectations around market performance will have an enormous impact on how happy we feel. For this reason, it’s paramount that we root both in logic and reality.

Income and happiness

There have been many studies centered around income and its relationship to happiness. One well-known study was conducted by Princeton researchers Daniel Kahneman and Angus Deaton in 2010. Together they found that day-to-day emotions didn’t improve past an annual income of $75,000. However, life satisfaction, or contentment felt when reflecting on life as a whole, did.1

Another more recent study was conducted by Purdue University in 2018. Their research team found that the ideal income for life satisfaction was $95,000 a year. But that anywhere between $60,000 to $75,000 annually could secure a sense of emotional well-being. However, they also found that earning more than $105,000 could lead to a decrease in happiness levels.2

Research like this shows us that income undoubtedly influences your happiness. They show that emotional well-being and life satisfaction depend somewhat on how much you earn. But they also reveal that money isn’t the sole factor. After a certain point, focusing on making more money to increase your happiness may be unfruitful, and potentially even harmful.

Cash-on-hand and happiness

Researchers at UC Riverside took things a bit further. They actually looked into the specifics of “liquid wealth” (i.e. cash-on-hand) and its influence on feelings of happiness. Put another way, they were trying to see if people were happier with more money in their bank accounts. And they found that they were!

People reported higher senses of life satisfaction when they had more cash-on-hand.3 But this clashes with many investor sentiments towards keeping cash in the bank. Avid investors often see opportunity costs in leaving money in the bank as opposed to growing it at a greater rate of return through retirement savings plans, 529 plans, or general stock market investing.

A rational way of resolving the dissonance between these two feelings is to focus on building up an emergency fund. This may allow you to experience the positive psychological benefits of seeing more liquidity in your bank account without feeling like you’re not taking full advantage of the greater rates of returns offered by the market.

Spending and happiness

Fascinating research has been conducted on consumer spending and happiness. More specifically, how different forms of spending impact your emotions while doing so. Below is a list of findings on different forms of spending.

Paying with Cash: Paying with cash is a more psychologically painful experience. That’s because the separation you experience from your cash is more obvious, immediate, and associated with specific items.4

Paying With Credit Cards: Credit cards make the separation from your money less transparent and immediate. They also make it easy to lose track of how much you’re spending, and what you’re buying.4 Unlike cash, credit cards are largely disconnected from the pain of spending. In fact, research has shown credit card spending gives us pleasure by stimulating the reward centers in our brain.5 Unsurprisingly, one key study found that credit card users were willing to pay 100% more when using a credit card compared to cash.6

Paying With Mobile: Spending via your mobile device may be even further removed from pain than plastic. Research has shown that people rate their level of pain experienced as lower when paying with phones compared to cards.7

While research indicates you’ll be happier spending with your credit card and phone, this disconnect from perceived consequences may not be such a good thing. If you’re not careful, your uninterrupted happiness can get you into some serious financial trouble.

Financial organization and happiness

Research also shows that if your finances aren’t organized, your happiness can take a hit. A Charles Schwab study found that 65% of people with a written financial plan felt financially stable. But only 40% without one, felt the same.8

Additionally, that same Schwab research indicated that an organized financial plan translated to healthier money habits. For example, 65% of those with a written plan had an emergency fund compared to only the 33% who didn’t.8 And as we saw from the research on cash-on-hand, that lack of liquidity can translate to a lack of happiness.

And don’t think poor financial organization only affects individuals. An American Psychological Association study found that money is a major source of conflict amongst 31% of adults with partners.9 Worse yet, a Kansas State University study found that arguments about finances were a top predictor of divorce.10

By working with an advisor to create a comprehensive financial plan, you’re bolstering your happiness along multiple dimensions. You (and a partner) can get clear about where you are, where you’re looking to go, and how to get there. In turn, you can enjoy your wealth with a greater sense of direction, security, and alignment.

How The Advisory Group helps

Helping our clients achieve their long-term financial goals is what we do best. And it’s a privilege to see the happiness that comes from succeeding in this pursuit. But those feelings don’t have to wait until retirement.

We’re here to help you get organized as you continue to build wealth. And we do this by setting savings targets, navigating taxes, and constructing your portfolio together. This can help make the best use of your working age, expectations, income, spending, and cash-on-hand.

If you’re ready to work with a team that helps you pursue your vision happily, we’d love to talk with you. All of our relationships with clients begin with complimentary consultation. You can schedule one here, or reach out to us directly at (415) 977-1200.

References:

- https://www.pnas.org/content/107/38/16489

- https://www.nature.com/articles/s41562-017-0277-0.epdf?sharing_token=P1S_0Evo-19rIaViyzQ-8dRgN0jAjWel9jnR3ZoTv0P6pRUGAIioLhu85ORBsjF_g5Rf0fuUViMASagr_M7VE7IS2FB5ZuMKojjmg5A5VzBOfFz5SIzoZhUmTma8TVCRL2SeHhJzzQ3eswfMAkVcpGxALMt4WpL6jnqu95ypK8UfEPAf2IN96_EEMsaQZurJREjTFPpDgGbxkcHV7IeRMQ%3D%3D&tracking_referrer=www.cnbc.com

- https://escholarship.org/uc/item/4k43h4c0

- https://psycnet.apa.org/record/2008-12802-002

- https://mitsloan.mit.edu/experts/how-credit-cards-activate-reward-center-our-brains-and-drive-spending

- https://web.mit.edu/simester/Public/Papers/Alwaysleavehome.pdf

- https://www.consumerreports.org/shopping-retail/how-you-pay-can-affect-how-much-you-spend/

- https://content.schwab.com/web/retail/public/about-schwab/schwab_modern_wealth_survey_2021_findings.pdf

- https://www.apa.org/news/press/releases/stress/2014/stress-report.pdf

- https://onlinelibrary.wiley.com/doi/10.1111/j.1741-3729.2012.00715.x

The information provided herein is for informative and educational purposes only. The use of hyperlinks to third party websites is not an endorsement of the third party. Third party content has not been independently verified. To understand how this content may apply to you, please contact a financial advisor.