Take charge of your midlife money – 7 financial planning areas to evaluate

Gray hair. Fine lines. A stubborn case of tendonitis. Besides the physical signs, there are other tells of middle age. For one, it might feel like someone has gone and pushed the fast forward button. Midlife (ranging broadly from your mid-40s through your early 60s) is an emotional, philosophical, and financial whirlwind of tasks and responsibilities like college payments, home maintenance, 401(k) contributions, and insurance.

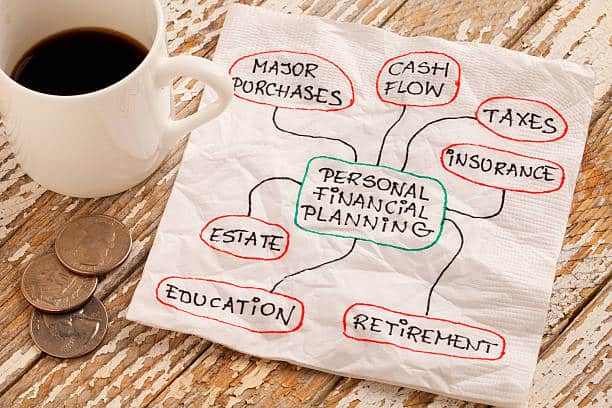

The once-far-away idea of retirement starts to feel more real, and you might find yourself asking “If I put the kids through college, will I still be able to travel when I stop working?” As that day inches closer and you accumulate more wealth, this is a great time to check in on your spending, saving, and long-term financial plans. Read on as we dive into the unique journey of midlife financial planning, including 7 major areas to consider (we suggest your download our Midlife Financial Evaluation Checklist to accompany this article).

Why financial planning in middle age is so important

Responsibility peaks at age 45, found financial services group Legal & General. Many households in this phase are juggling children, mortgages and a full-time job or a business. They may also be supporting a parent in decline. All while trying to stay active, eat well, meet with friends…oh, and don’t forget planning for retirement.

While every family has financial responsibilities to manage, a few key factors make midlife a crucial time for financial planning:

- You may have evolving family situations (divorce, kids going to college, aging parents, etc.) that change your priorities and financial responsibilities.

- You’re likely earning and accumulating more in this phase, which means you have higher potential for savings and investing.

- Retirement is in sight within the next decade or two, and you’ll want to make sure you’re on track to meet your future financial goals. We will evaluate current retirement savings before we discuss retirement planning.

A midlife check-in gives you time to adjust and optimize your spending, savings, and investment plans for the next few decades. Setting up (or recalibrating) your financial roadmap now will help prepare you and your family for a successful retirement later.

The midlife financial check-in: what to consider

There’s more to financial preparedness than the size of your investment accounts. When it’s time to do a financial check-in, here are some areas to consider beyond your net worth.

Support for family members

Many people choose to balance their own wealth accumulation with providing support for family members. For example, do you have plans to help pay for college, a wedding, or a deposit for a first home?

There are tax-friendly tools, like 529 plans, available to help save for children and grandchildren’s education expenses—make sure you’re using them to your advantage. If you have any children under 18, you could set up a custodial Roth IRA to help them build wealth over the long term.

And if you have older relatives needing long-term healthcare, in-home care, or other ongoing support, this also needs to be factored into your plan.

Lifestyle and retirement goals

“What’s next for me?” comes up for many people during this time. As children start leaving the house and retirement comes into closer view, many midlifers begin trying to picture what their second act will look like.

Maybe you dream of moving abroad or getting back to nature. Or, perhaps you imagine a semi-retirement involving rental properties, consulting, or another part-time source of income. Assess your lifestyle and goals to make sure you’re prepared for major upcoming costs, whether that’s family care, an extended sabbatical, or a second home.

Health status

We’ve mentioned aging parents, but what happens when your own health gets in the way? Throughout life, you (or your spouse or child) may have an injury or illness that affects your healthcare costs and ability to work. Whether you’re a business owner or an employee, disability insurance provides income protection in the event you can’t work.

Additionally, many Americans will need long-term care (such as a nursing or retirement home) at some point in their lives. Someone turning 65 today has a nearly 70% chance of requiring long-term care services in the future. And Medicare won’t cover everything. Plan for the costs now and save your family the stress of it later.

Social security claiming

You can start receiving reduced Social Security benefits as early as age 62, but you’re entitled to full benefits when you reach your full retirement age. If you delay taking benefits past your full retirement age, your benefit amount will continue to increase until age 70.

Check your Social Security account to estimate how much you’ll get when you apply at different times between age 62 and 70. Keep in mind, your ideal plan may need to change due to health or work issues that arise.

Couples can coordinate their Social Security claims to optimize for the highest benefit. For example, claiming at different ages and delaying claiming the higher-earner’s benefits is a common strategy.

Tax strategy

Tax planning becomes key as your net worth grows and your financial situation becomes more complex. For example, have you bought or sold any real estate? Recently done a remodel or home upgrade? Intend to cash in company stock or exit an investment? All of these situations have tax implications.

If you’re not already doing so, maximizing your contributions to tax-deferred retirement accounts like 401(k)s and IRAs lowers your taxable income now and lets your wealth grow tax-free.

Legacy and estate planning

Estate planning and tax strategy go hand in hand, especially when you want to maximize the amount of money you leave to your heirs. For example, you could create a trust to transfer assets to your children in a tax-efficient way. You might also consider adjusting your life insurance to provide financial security for your family if something were to happen to you.

More importantly, midlife presents a rare opportunity to help your parents make preparations they may have ignored, like advanced medical directives or a will. At the same time, you should be making plans for your own estate.

If something were to happen to your mom or dad—would they want to be put on life support? If you have siblings, which one of you will make the decisions? These are questions every child asks when they start to notice their parents getting “old”. Now, imagine your children asking them about you. It may feel a bit macabre, but when the time comes, having these things figured out is always a relief.

Investment risk and allocations

When life circumstances shift, your game plan needs to shift too. There are a number of events that might prompt you to update your investing strategy, allocations, and/or risk tolerance, for example:

- Going from employed to business owner or vice versa

- Buying or exiting a business

- Changing career or income level (e.g. a promotion or a job loss)

- Getting divorced, married or remarried

- Having children or grandchildren, adopting kids, becoming a stepparent

- Feeling like you might be paying too many fees

A portfolio review is also a good idea when there’s a major market shift, such as the current rising cost of living and inflation, especially if you do not currently have an advisor keeping track of your investments.

If reading this sparks feelings of overwhelm, don’t worry. It’s never too late to start or reevaluate your financial plan. Whether you’re in your 40s, 50s, or even 60s, you can still take actions to improve your financial situation and build a successful retirement. And if you do need professional help, you can consult with one of our fiduciary financial planners. They can provide objective advice and expert guidance tailored to your specific situation.

The information provided herein is for informative and educational purposes only. The use of hyperlinks to third party websites is not an endorsement of the third party. Third party content has not been independently verified. To understand how this content may apply to you, please contact a financial advisor.