A note about market volatility

We wanted to reach out to you given the recent volatility in the stock market. We understand that it is natural to feel uneasy when there are significant market fluctuations, especially when it seems like “this time is different” but we want to reinforce why staying invested is crucial for your long-term financial success.

Market Volatility is Normal

It’s important to remember that volatility is a feature, not a flaw, of our stock market. When we look at history, markets have faced major disruptions time after time, whether the dot-com bubble, the 2008 Global Financial Crisis, or the COVID-19 crash. Every market cycle comes with unique challenges, whether it is inflation, geopolitical uncertainty, or the threat of recession. Each time investors worried that “this time is different,” yet markets recovered and reached new highs.

It’s important to remember that volatility is a feature, not a flaw, of our stock market. When we look at history, markets have faced major disruptions time after time, whether the dot-com bubble, the 2008 Global Financial Crisis, or the COVID-19 crash. Every market cycle comes with unique challenges, whether it is inflation, geopolitical uncertainty, or the threat of recession. Each time investors worried that “this time is different,” yet markets recovered and reached new highs.

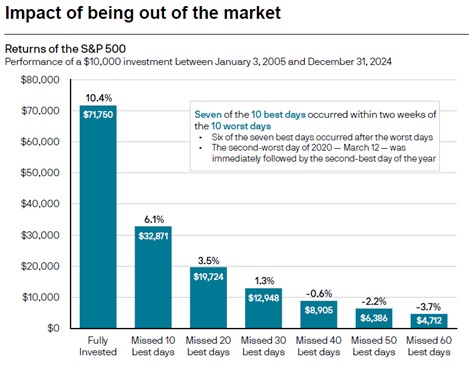

Attempting to time the market by pulling out and reinvesting at the “right” moment is nearly impossible and can lead to missed gains. It requires making two decisions correctly: when to get out, and when to get back in. Many of the strongest market rebounds occur shortly after downturns, meaning that missing just a few of these key days can significantly impact long-term returns (see chart).

Chart Source: JP Morgan Asset Management, using data from Bloomberg.

Managing Uncertainty

One of the key ways to manage market uncertainty is by ensuring that you have adequate cash reserves. This cash cushion allows you to cover short-term needs without having to sell investments at inopportune times. The amount will vary depending on your circumstances; we are happy to discuss this as this relates to your situation.

Diversification also helps to mitigate risk. A well-diversified portfolio can help smooth out market volatility and reduce the impact of downturns on your overall investments. As we have discussed in our “Quarterly Context,” recent valuations of domestic equities seemed unsustainably high and overperformance was concentrated in just a few stocks. Along with discipline and patience, a well-diversified portfolio can help you weather short-term volatility. A downturn also provides opportunities to rebalance and harvest tax losses in taxable accounts, to be used later against realized capital gains.

While challenging over the short-term, staying invested allows your portfolio to capture the benefits of a market recovery.

We greatly appreciate your continued trust and confidence. Together, we’ll navigate these market conditions and keep you on track to achieve your financial goals. If you’d like to talk through your portfolio, goals, or any concerns you have, we’re here to help. Please do not hesitate to reach out.

The information provided herein is for informative and educational purposes only. The use of hyperlinks to third party websites is not an endorsement of the third party. Third party content has not been independently verified. To understand how this content may apply to you, please contact a financial advisor.