Solo success: how to thrive financially as an independent woman

Are you one of the many accomplished solo women out there, thriving and conquering life on your own terms? Navigating the financial landscape on your own can feel daunting, but with a tailored approach, it also leads to exciting opportunities.

“Solo” may include women with or without children, widows, divorcees, and women who’ve never been married. Keep in mind, even if you’re married or partnered now, you could become divorced or widowed in the future. And, given that women live an average of five years longer than men, it’s likely that most women will be on their own at some point.

So, whether you’re regrouping after a significant life change, gearing up for an exciting next chapter, or planning ahead for retirement, we’ve got you covered. This guide dives into the nuances of financial planning as an individual rather than as a couple.

More women are planning independently for their future

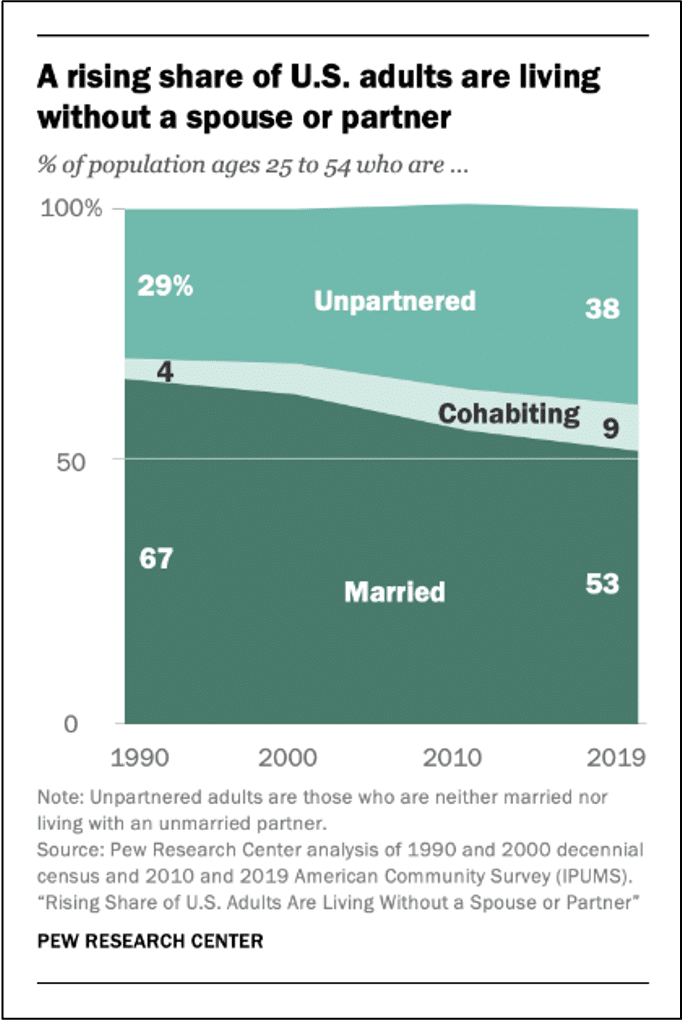

If you’re living your life independently then you probably already know—while you may be solo, you’re definitely not alone. In fact, there are more single U.S. adults than ever before. As of a few years ago, 38% of adults aged 25 to 54 are living without a spouse or romantic partner (compared with 29% in 1990).

Women have also gained more financial freedom over the years, from career and educational opportunities to a rise in independent homeownership. In 2022, single women accounted for 58% of homes owned by unmarried Americans, versus 42% of single men.

As trends change and more people embrace the freedoms of flying solo, we’re seeing more women making their own independent financial plans. Our goal is to provide personalized insights and advice to help women make more informed financial decisions.

Benefits and drawbacks of living solo

One of the biggest benefits of living alone is, of course, having full control over personal and financial decisions. From where you go on vacation to what you have for dinner, flying solo means you’re in charge.

Being single also means more career flexibility. For example, if a career opportunity comes up in another state, there’s no need to consider a partner’s job. Financial life is also simpler as a single person. Fewer bank and investment accounts can make it easier to see the big picture and set realistic goals.

On the downside, single living comes at a premium. According to data, single people spend nearly $5,500 more on housing expenses each year than married couples. Most cohabitating couples also share basic expenses like utilities, food, and health insurance, which you have to cover yourself.

All this means, being on your own requires a stronger financial foundation in order to achieve long-term financial success.

Financial planning for successful solo women

There are plenty of special financial and planning circumstances we take into account for single clients—especially single women. Let’s take a look at five main areas of financial planning, and the major considerations specific to each.

1. Financial independence

Financial independence is about building wealth over the years to fund your retirement or a work-optional lifestyle. But also, it’s about giving you options pre-retirement. Whether it’s a career change, a sabbatical, or reducing your workload, planning ahead is key.

Here is some of the advice we offer solo women looking to gain financial independence:

- Start saving as much as possible, as early as possible (since you’ll be funding your goals on your own).

- Align your portfolio to invest for the long term—women have a more successful investment experience when they have a plan they can stick to.

- Check your Social Security account each year to understand your future benefits, and make a plan to account for any gaps in contributions.

- If you have a pension, opt for a single annuity payout to your payments in retirement (since you don’t have to cover any benefits for a surviving spouse).

- Singles need to maintain a larger-than-normal emergency fund, consisting of nine months to a year’s worth of cash reserves.

- Advocate for yourself in your career, including negotiating for compensation that’s on par with your male colleagues.

2. Tax planning

Single filers may not get the same tax breaks as married couples, especially when it comes to deductions and exemptions. There are pros and cons to it, but here are a few of the top tax planning considerations for single people:

- “Single” taxpayer status is generally simpler than filing jointly, since you don’t have to consider the income and deductions of anyone else.

- You’ll likely be in a higher tax bracket as a single person, so do some tax planning to minimize your tax bill.

- You might be eligible for some tax credits even as a single filer, like the earned income tax credit or the child tax credit (if you have dependents).

- If you’re single with custody of children, filing as Head of Household is generally the most advantageous.

- It may become easier to hit certain deduction thresholds, such as for medical expenses, when using a single income versus combined.

- If charitable giving is important to you, consider tax reduction strategies such as a charitable remainder trust or a donor advised fund (DAF).

3. Estate planning

Estate planning is key to making your wishes known, both during and after your lifetime. If you have specific wishes regarding your financial legacy, passing on family heirlooms, or even what music you want played at your funeral, estate planning is your best chance of making those desires a reality. Here are some of the most important things to think about with regard to estate planning:

- Name someone (whether that’s a family member or a professional trustee) as the executor of your estate.

- Name a successor trustee of your living trust, if you have one.

- Write a letter of instruction stating your wishes for things like end-of-life arrangements, as well as a list of your accounts, and contact info for your CPA and estate attorney.

- Appoint someone as power of attorney to make legal and financial decisions on your behalf, in case you ever can’t.

- You may also want to appoint someone to make medical decisions on your behalf using a medical power of attorney.

- Structure your brokerage accounts to pass directly to your designated beneficiaries without going through probate, either by setting up a living trust or including a “transfer on death” designation.

- Be mindful of estate tax limits in your state and consider strategies to reduce your estate, if necessary, to reduce taxes.

- If you have pets, create a plan for who should take care of your pet if something happens to you (you can include this in the letter of instruction).

4. Risk management

As your personal wealth grows, so does your liability. That risk is even bigger when you’re living independently—which is why risk management is so important for successful solo women. To protect everything from assets to income, consider the following:

- Carry disability insurance to protect your income and standard of living in case of a medical issue that prevents you from working.

- Umbrella liability insurance will cover you in extenuating circumstances, such as an injury that occurs on your property.

- Evaluate long-term care insurance to help with the cost of extra care in your later years.

- You may have less need for life insurance than a married person (the exception being if you have dependent children).

5. Healthcare planning

Beyond long-term care insurance, there are many other health considerations for women who are living alone in their later years:

- Communal living with other, unrelated women is an option that lets you share costs, companionship, and support, a so-called “Golden Girls” arrangement

- Build a network of “chosen family” to check in on you or help with errands and doctor’s appointments as you age.

- A death doula may be helpful as you near the end of your life, by providing comfort and company as well as advocating for you in your last wishes.

Additional considerations for divorced women

Divorce is never easy, and it can have negative consequences for your finances. But with the right strategies and guidance, you can protect your wealth and come out as strong as possible financially.

- If you were married for more than 10 years, you can get Social Security and Medicare benefits based on your ex-spouse’s benefits, including as a surviving spouse.

- If you remarry, your benefits based on an ex-spouse will terminate, unless you’re over age 60.

- Retirement assets accumulated during the marriage are split evenly, and should be penalty free as long as you choose the Qualified Domestic Relations order (QRDO) option.

- If you didn’t do so while you were married, establish credit cards in your own name and begin building your own credit history.

- Be sure to update the beneficiaries on your insurance and retirement plans when you divorce.

Social Security and retirement account considerations for widows

If your partner passes away, their Social Security benefits can play a big role in your finances. So, it’s worthwhile to evaluate the various claiming strategies for your situation to maximize your benefit:

Widows or widowers can receive survivor benefits based on the deceased spouse’s earnings record.

- The surviving spouse is eligible for full survivor benefits at full retirement age (FRA), which is currently 66 or 67, depending on the year of birth.

- You can switch to your own benefit later.

- You can claim survivor benefits as early as age 60, but they will be reduced if claimed before the survivor’s full retirement age.

- The reduction in benefits is prorated based on the number of months before reaching full retirement age.

We also want to make one important note about other retirement benefits, such as those received from an employer-sponsored retirement plan:

Generally, you must be over age 59 ½ to draw upon a tax-deferred retirement plan without paying a 10% penalty for early withdrawal.

- If your partner passes away and leaves their 401(k) to you, you can avoid this penalty, as long as you draw directly from the plan (you cannot roll it into your own IRA).

Giving singles the financial confidence they need

As you can see, solo women encounter unique circumstances in nearly all aspects of financial planning. We’ve touched on many of the points we take into account when planning for single clients. However, there’s much more detail to each aspect, and the specifics may vary based on your personal situation.

If you’re feeling overwhelmed or have additional questions, professional guidance can help to determine the best route for you. Book a meeting with one of our financial planners to explore your options.

The information provided herein is for informative and educational purposes only. The use of hyperlinks to third party websites is not an endorsement of the third party. Third party content has not been independently verified. To understand how this content may apply to you, please contact a financial advisor.