Why Rebalancing your Portfolio in the Midst of Crisis is Essential for Long-term Success

In the midst of the COVID-19 pandemic, the term rebalancing now extends past investment portfolios as we all rebalance our lives around staying at home, creatively social distancing, and protecting our health. It is a rebalancing act that people did not anticipate; we’re all learning lessons that will linger on once this crisis is behind us.

The rebalancing that we do anticipate, however, is investment portfolio rebalancing. This discipline of keeping a portfolio’s mix of investments in check is a critical part of our risk control and return enhancement process and one that allows us an unemotional way to help keep our clients’ plans on track.

Setting your Target Investment Allocation

When we first set the investment allocation (that is, the mix of stocks, bonds and cash we hold in a portfolio), we take into account our clients’ financial goals and make certain rate-of-return assumptions to project long-term growth. Maintaining this target allocation, or mix, both on a broad basis (equities vs. fixed income), and with specific sub-groups (e.g. Foreign stocks vs. U.S. Small Cap or muni bonds vs. cash) is important to the validity of our long-term projections. Straying too far from these targets can be costly in terms of risk and potentially be a factor that keeps you from reaching your goals.

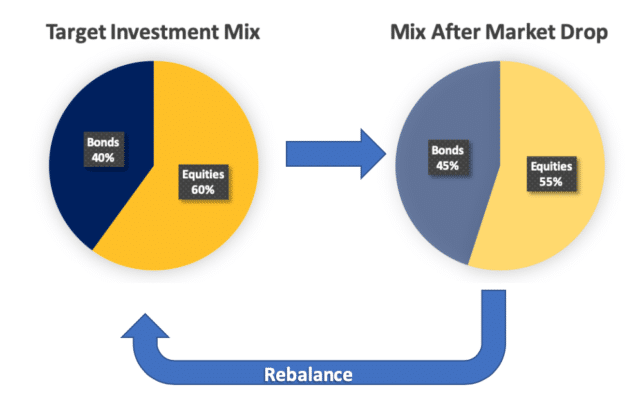

Let’s work through an example. If your target allocation is an investment portfolio with 60% equity and 40% fixed income, and the stock market (equities) drops so that the market value of your investments is now 55% equities and 45% bonds (see Figure 1 below), we need to rebalance your portfolio. We would sell from your fixed income side and use the proceeds to buy equities to balance your portfolio back to the 60%/40% target.

When Do We Rebalance Client Portfolios?

Even though rebalancing can be challenging during volatile market conditions like we have experienced over the past several weeks, it is no less critical to long term success. How do we know when the right time to rebalance is? For the portfolios we manage for participant-directed plans such as 401(k) plans and 403(b) plans, we rebalance on a regular schedule, and consider additional rebalancing if there are material market shifts. When it comes to personal wealth client portfolios, we leverage technology to identify two triggers for rebalancing:

- 5% threshold: When the overall broad target mix shifts by 5% we receive an alert. For example, the Figure 1 portfolio changes from 60% equity to above 65% or below 55%.

- Sub-asset class volatility-weighted tolerance: We evaluate based on thresholds for each type of equity or fixed income category (known as sub-asset classes) within the portfolio. The thresholds are based on the allocation to each sub-asset class and the projected volatility of each sub-asset class.

While technology systematizes the identification of the possibility of rebalancing, whether or not changes need to be made require human help. That is where we, as your advisor, come in to make the decisions for each individual portfolio based on our specific knowledge of your personal situation. Do you have upcoming cash needs? Is there a change in your financial goals? Do you require a change in strategy based on new circumstances? This personalized layer is essential to confirm the degree of rebalancing needed.

Crisis Rebalancing May Make a Difference

While we rebalance to reduce risk and keep client portfolios aligned with their personal goals and tolerance for risk, some research indicates that rebalancing often improves portfolio performance. Analysis by BlackRock shows that an actively rebalanced 60/40 portfolio of indexes would have performed 1.72% higher versus not rebalancing during the 2008 Financial Crisis. Rebalancing when stocks are down systematically purchases stocks and lower prices, which magnifies the effect of the eventual recovery.

Of course, it is impossible to predict the perfect time to rebalance. A major market drop may be the bottom, or it could continue to a deeper bottom, and it can feel counter-intuitive and uncomfortable for clients to buy into a falling market. Nonetheless, the process of rebalancing has still been shown to be beneficial even when not perfectly timed.

Balancing Risk and Costs

A successful rebalancing strategy strikes a balance between maintaining the desired level of risk and incurring increased transaction costs. For taxable portfolios, we may also be harvesting tax losses as we make rebalancing changes. Where advantageous and possible, we target changes to take place in tax-deferred portfolios, if that is beneficial for the client.

Smart rebalancing can be a complex process, but it is a critical part of long-term risk management and return enhancement, towards achieving client goals. While our clients have control over high-impact actions to help keep their goals on track, such as spending and saving consistent with the requirements of their long terms goals and plans, we are here to support clients by taking the emotion out of volatility, keeping cool during crises, and rebalancing portfolios, as part of doing all that we can to serve our clients’ long-term goals.

The information provided herein is for informative and educational purposes only. The use of hyperlinks to third party websites is not an endorsement of the third party. Third party content has not been independently verified. To understand how this content may apply to you, please contact a financial advisor.