Wealth creates new opportunities…

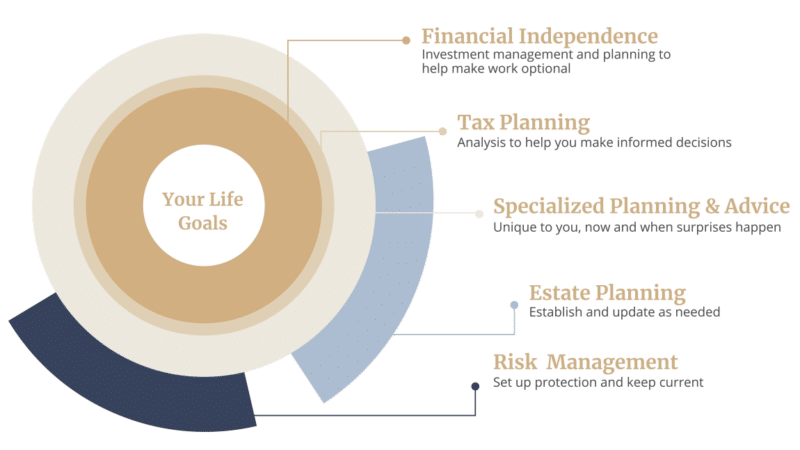

…ones that can improve your financial health or offer more time to spend on what matters most to you. Through our personal wealth management service, we provide perspective and objective analysis to help you evaluate options and make decisions with your full financial picture and life goals in mind.

Experience a custom financial plan and investment strategy to serve your wealth and life goals so you’ll feel confident to pivot or pursue your next opportunity. That’s Wealth & Life Strategy.

As fiduciary, Certified Financial Planner™ professionals, we address all aspects of your financial life. You’ll know we’ve covered all the bases, and we’re here to help as your life changes. Experience the freedom of exceptional Wealth Management – a financial plan driven by your goals and backed by investments that serve what you want.

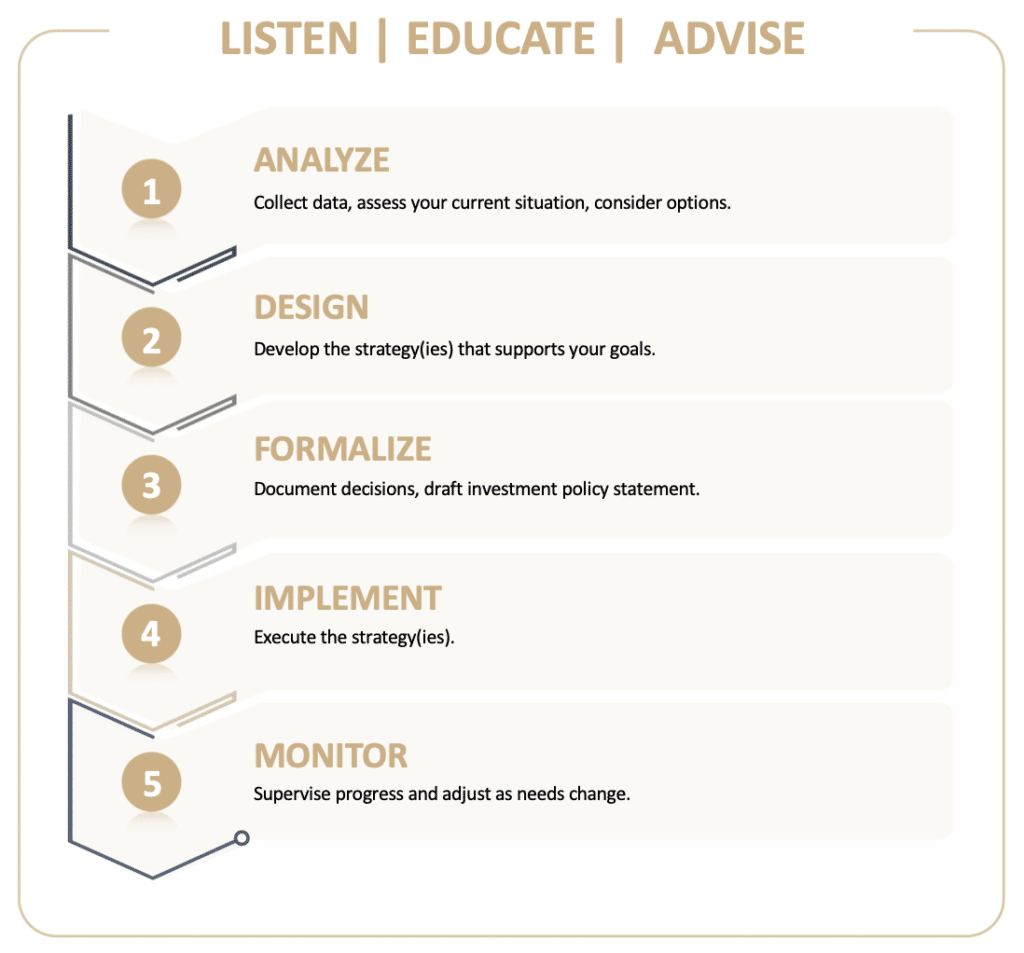

Our 5-Step Wealth Management Process

With our Wealth & Life Strategy approach to Wealth Management, we gain a true understanding of your aspirations and concerns before we build a plan. Working with you, we navigate the possibilities and evaluate options.

From here, we design and help you implement a financial plan that is centered on achieving your life goals. And with ongoing monitoring, we make sure you stay on track.

Wealth and Life Strategies for those experiencing Peak Busyness.

We specialize in helping those who are immersed in the “midlife experience” use their resources to find fulfillment and freedom.

Never is the conflict between time and money felt as acutely as in midlife. For many people, this is the time of peak busyness with family responsibilities and work demands at their highest.

Research over the last decade built on the “U-Bend of Life” points to age 47 as the low point for happiness; “peak busyness” is a reality. As financial advisors, we believe we can mitigate some of the stress by connecting your wealth to your life.

Deep in the midlife experience, you may be:

- preparing to launch your children,

- starting to help aging parents, and

- approaching or experiencing your peak earning years.

In this complex life stage you may wonder:

- How can we keep from missing out on family life while trying to save for what may be a long retirement?

- Is it possible to take a hiatus and pull back from my business?

- How long do I need to keep doing what I am doing to be prepared for ‘later?’

- What impact will trading off money for time (to spend time with kids, take advantage of good health, travel and create new memories) have on our financial security?

- Will our ‘ideal life’ continue to unfold if we make a change?

We’re here to help.

We work with you to secure your personal wealth and turn your success into freedom. Through our Personal Wealth Management service, we take the overwhelm out of the time vs. money conflict and help you make clear decisions. We will handle the complexities so you can focus on what matters most.