Investment returns: How Optimistic Should You Be?

Investment returns may not be on your mind right now as the summer brings highly anticipated changes where we can re-engage with our loved ones and communities in person. It will take some time to gain perspective on the economic and social implications of the global pandemic, especially since its effects have varied among different populations. One impact we see already, though, is a change to the way we think about our personal finances, priorities, and the strength of our markets and the economy overall.

We saw many of the principles of prudent financial planning and investing play out during the pandemic, including the importance of having emergency savings and an estate plan in place, as well as the rewards of not attempting to time the markets. Since we had both the quickest market downturn and then the fastest recovery ever in 2020, we gained more evidence that staying invested works, even in unprecedented times.

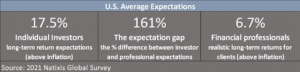

Individual Investors vs. Financial Professionals on Investment Return Expectations

Early indications are that, having come through the pandemic, many investors are overly optimistic about the investment returns they can expect in the future. In the 2021 Natixis Global Survey of over 8,000 affluent investors, the expectations of investors were found to be surprisingly higher than what most financial professionals (including u s) expect. According to the study, global investors’ expectations for long-term market returns are 14.5% above inflation. U.S. investors are even more optimistic, expecting 17.5% above inflation over the long term. U.S. financial professionals, by comparison, had expectations of 6.7% over inflation, leaving an expectations gap of 161%.

s) expect. According to the study, global investors’ expectations for long-term market returns are 14.5% above inflation. U.S. investors are even more optimistic, expecting 17.5% above inflation over the long term. U.S. financial professionals, by comparison, had expectations of 6.7% over inflation, leaving an expectations gap of 161%.

Tempering Your Investment Return Outlook

Why the disconnect? For many investors, the recovery has meant higher home values, more savings, and a job market that gives them the confidence to spend and help drive the economy further. Professionals see corporate earnings that, while strong, will be challenged to support such continued growth in stock prices. There are also concerns about how the inflation that is accompanying the recovery will be managed. This includes not only Fed action but changes in global supply chains, the availability of cheap labor globally and the e-commerce that has kept prices low over the past 10 years.

In our planning and investing for our clients, one of the most important things we do is set realistic expectations, so that your plans for your life can be achieved. If you’re curious about what these forecasts mean for achieving your life goals and you want an outside perspective on your investment strategy, please reach out for a complementary conversation.

This article is a reproduction of our client quarterly letter which we are sharing to help provide insight and education for more people.

The information provided herein is for informative and educational purposes only. The use of hyperlinks to third party websites is not an endorsement of the third party. Third party content has not been independently verified. To understand how this content may apply to you, please contact a financial advisor.