Second homes: what to consider before you buy

Did the pandemic cause a bit of cabin fever? If so, you’re not alone. Ideas of buying a second home grew in popularity alongside desires for changes in scenery and new work-from-home norms. But like your first home, the purchase of a second deserves its due diligence. That’s because it’s not always a fiscally responsible move.

Second home – double duty

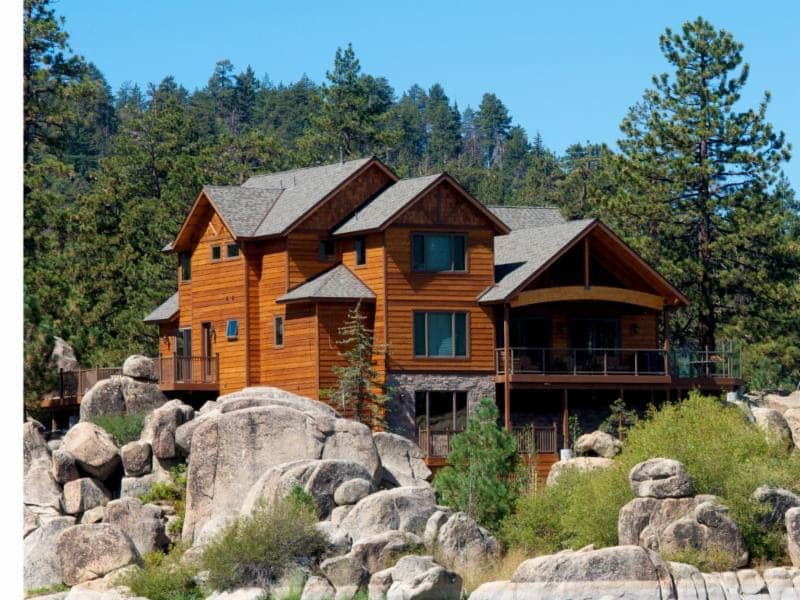

Ideally, a second home is an appreciating asset with long-term value. For the right property, a second home can be a lifestyle enhancement with expenses similar to family vacations. This home can serve as a regular vacation getaway and a place to create family memories. You could also use it as a home exchange, swapping residences when you visit other places.

You can keep the expenses down if you have the ability to rent the property when you are not using it, providing a passive income stream. But that’s not always the case. Second homes are still subject to ongoing maintenance costs, tenancy issues, illiquidity, and market volatility. Additionally, if you buy one with a mortgage, your rates are usually less favorable than the one for your primary residence.

To hedge against these risks and expenses there are a variety of financing strategies available. For one, you can enter into a co-op with friends or family members. This can maximize usage of the property and share the burden of costs. But keep in mind the potential strain on your personal relationships this can have should issues arise.

What about shared ownership?

There’s also an emerging corporatized version of this. It’s called Pacaso, and they sell shared ownership of luxury secondary homes. This form of purchase still leaves a lot to be wondered. It’s perhaps too early to tell how the resale of equity share will be priced going forward and whether or not mainatinece of their properties will remain at higher levels.

If the rest of your financial life is on track. purchasing a second home may be the right decision for your family. But it’s only a decision you can afford to make once you understand the risks, costs, and the full extent of your financial situation. If you’re thinking of moving forward on a new property, we invite your schedule a call with an advisor to see how it fits with the rest of your plan.

The information provided herein is for informative and educational purposes only. The use of hyperlinks to third party websites is not an endorsement of the third party. Third party content has not been independently verified. To understand how this content may apply to you, please contact a financial advisor.