What to do in a volatile market: Should I sell my stock?

The stock market has been anything but stable recently. And unsurprisingly, that usually means our emotions haven’t been either. Financial freedom is tied to market performance, and when you start hearing about “down markets” or “recessions,” one question tends to come up in our nervous brains…

Should I sell my stock?

At its face it seems like a reasonable question. Afterall, if the market is headed for a prolonged downturn, it’d make sense to cash out now. It’d be better to cut your losses sooner rather than later. Then you could wait until the market is “safe” before you buy back in.

But is this reason talking, or is it fear? When it comes to money, your decisions have to be rooted in level-headed thinking. Too often investors lose in the long-run because of emotional choices they made in the short-run. Staying invested in the market is commonly the right path, but making this decision can be difficult. In this article, we’re going to review the history of volatile markets, the lessons they taught us, and the best way to make decisions when markets make us nervous.

Historical stock market volatility

We often hear that history is the best teacher. And that’s hard to argue against in the world of investing. The U.S. economy has known its fair share of volatile markets, and when met with a studious eye, you’ll be able to start seeing some universal patterns.

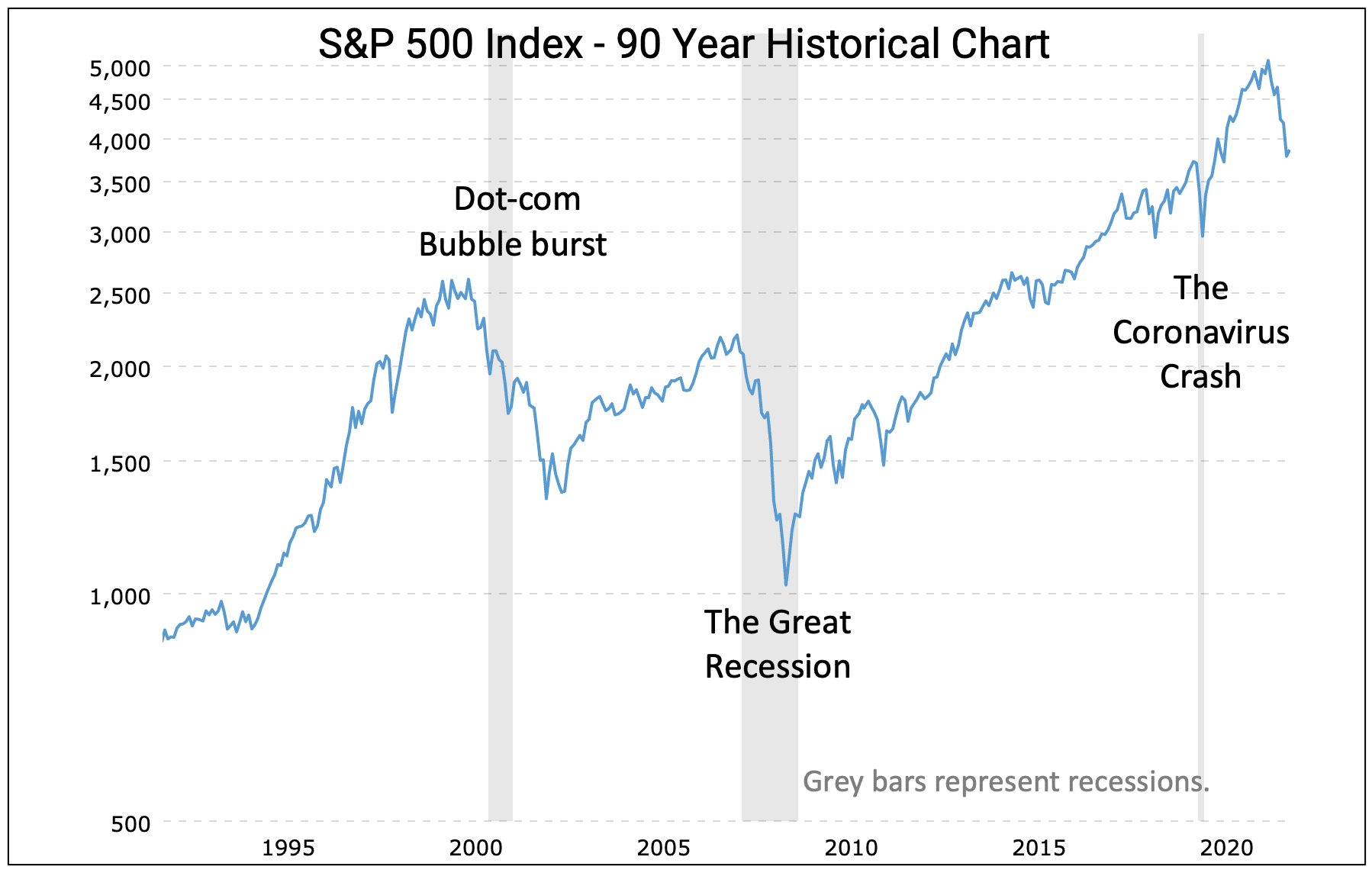

Let’s review three major market corrections: the Coronavirus Crash, the Great Recession, and the Dot-Com Bubble burst. We’ll look at what caused them and how long it took each to recover.

The Coronavirus Crash

In 2020, the coronavirus outbreak caused a stock market crash. This was largely due to the enormous impact travel restrictions and social distancing policies had on businesses. But consumer panic selling only exacerbated problems. Between February and March of 2020, the Dow Jones Industrial Average (DJIA) dropped 37%.1

Thankfully, the tide of this crash turned rather quickly. By mid-August the Standard & Poor 500 (S&P 500) was setting all-time record highs 2, and by late November, the DJIA started doing the same.3 In less than a year, things were better than ever in stock market terms.

The Great Recession

Between December, 2007 and June, 2009 we saw one of the worst market corrections in history.4 The Great Recession, sometimes referred to as the Global Financial Crisis, came largely from a combination of consumer overborrowing, rating agency negligence, and deceptive banking practices. These issues came to a head as market indexes like the S&P 500 lost over 50% of their value.5

The market began to recover in early 2009, and indexes like the DJIA were hitting all-time highs again by 2013.6 While not all economic measures of strength rebounded as quickly, they did eventually. The unemployment rate and real median household income, in 2015 and 2016 respectively, reached their former bests before the recession.6

The Dot-Com Bubble burst

During the 1990s internet and technology-related stocks became red hot. As a result, many new tech-based companies started popping up. Over an 18-month time frame, the NASDAQ’s value tripled and peaked in March, 2000.7

Many of the new companies that started up began to fail, and the overhyped value of the tech stocks came to a head when the bubble finally burst.7 What followed was the NASDAQ losing over 50% of its value. While tech stocks took 17 years to make a full recovery and hit new highs,8 other sectors in the market were able to make their recovery sooner propelling growth across the stock market.

What can I learn from volatility?

Now that we’ve covered some history of volatile markets, let’s review the lessons they’ve taught us. Namely, the principles we can take away based on the patterns present in each of the market corrections we went over.

Diversification is critical

During the pandemic, retail was hit particularly hard. During the Great Recession, it was the housing market and financial companies that took the big blows. And after the Dot-Com Bubble burst, it was tech that we saw plummet.

Granted, these crashes had negatively impacted the market as a whole. But not all asset classes were impacted as harshly. In fact, some managed to thrive. For example, during the pandemic, real estate values soared due to factors like higher personal savings rates and low mortgage interest rates. The point is, if your portfolio isn’t diversified, it isn’t protected.

Expect volatile markets and plan accordingly

When planning your portfolio, you should anticipate the risks of future volatility. History has shown us that corrections, crashes, and recessions are inevitable economic cycles. For this reason, it’s paramount to create a comprehensive financial plan that accounts for risk, and provides you with a course of action to stick to regardless of temporary market conditions.

To help you take action in times of uncertainty, focus on what you can control. You control your behavior. You control the information you seek out. You control whom you speak with to keep level-headed. By leveraging personal autonomy, you can begin gaining confidence. You’ll build inner strength as you work your financial plan that was pre-built for times like these.

The stock market has always recovered

You may not know when the market will make a recovery. But history shows you it always will. In some cases, like the Dot Com Bubble, the S&P 500 as a whole took 7 years to recover.9 But in others, like the COVID-19 crash, it took under a year. When our fear-based emotions take over it can cause us to think the market is doomed forever. But they’re wrong!

Timing the market is futile

We know markets crash, and we know they recover. But what we don’t know is when. Trying to time the market is an exercise in futility. Your emotions will often try to convince you otherwise. You’ll see the market going down and want to panic sell, or you’ll see it going up and not want to buy at a high. That’s two decisions you have to get right, which are both nearly impossible on their own. Emotional, reactionary investing is no recipe for long-term success.

There’s opportunity in volatility

Powerful, contrarian investors like Warren Buffet see opportunity amidst the uncertainty. With the right mindset shift, market corrections can be seen as fire sales for strong long-term investments. Those that continue to invest in solid, diversified holdings can find themselves coming out on the other side not only fully healed, but better than ever.

So, should you sell your stock?

The answer to this question is it depends. Factors like emergency situations, unforeseen opportunities, and lifetime horizons may justify the selling of stocks in a down or volatile market. But more often than not, if you’ve designed your portfolio properly, the selling of stocks during this time is a mistake.

By refusing to sell your stock out of fear, you prevent a variety of things from happening. You avoid getting into the habit of making emotion-driven, reactionary investment decisions. You don’t lock in your losses. And you don’t miss out on the opportunity to capitalize in the long-run by buying in when market prices are down.

Ultimately, this is a question you’ll want to run by a trusted financial professional. It can be difficult to view your own financial situation objectively. But by reviewing your goals and your portfolio’s present standings with an advisor, you can maintain a healthy perspective.

Note: If you think your situation may call for stock selling, you may want to consider taking advantage of tax loss harvesting. A financial advisor can help you best leverage the losses on your portfolio to lower your overall tax liability. This frees up capital to take advantage of similar positions at a lower cost (as long as you avoid the wash-sale rule).

How The Advisory Group helps

Long-term financial success is our core objective for our clients. One of the biggest ways we accomplish this is by helping those we work with maintain a disciplined and evidence-based approach to their investments.

We understand how scary it can be to watch as your financial future oscillates with a volatile market. But we also understand how to combat these fears, and keep you and your retirement on track to thrive.

If you’re ready to work with a team that has your back in volatile times, we’re here for you. All of the long-term strategies we develop with clients begin with a complimentary consultation. You can schedule one here, or reach out to us directly at (415) 977-1200.

References:

- https://www.investopedia.com/timeline-of-stock-market-crashes-5217820

- https://www.nasdaq.com/market-activity/index/spx

- https://www.wsj.com/market-data/quotes/index/DJIA/historical-prices

- https://www.pewresearch.org/social-trends/2019/12/13/two-recessions-two-recoveries-2/#:~:text=The%20Great%20Recession%20lasted%20from,last%20observed%20in%20the%201960s.

- https://www.federalreservehistory.org/essays/great-recession-of-200709#:~:text=Lasting%20from%20December%202007%20to,longest%20since%20World%20War%20II.&text=The%20Great%20Recession%20began%20in,recession%20since%20World%20War%20II

- https://www.investopedia.com/terms/g/great-recession.asp#:~:text=Financial%20markets%20recovered%20as%20the,2013%2C%20broke%20its%202007%20high

- https://www.investopedia.com/terms/d/dotcom-bubble.asp

- https://www.reuters.com/article/us-usa-technology-stocks/after-17-years-sp-tech-index-breaks-record-idUSKBN1A42O2

- https://www.wsj.com/market-data/quotes/index/SPX/advanced-chart

The information provided herein is for informative and educational purposes only. The use of hyperlinks to third party websites is not an endorsement of the third party. Third party content has not been independently verified. To understand how this content may apply to you, please contact a financial advisor.