History lesson: election impact on the stock market

We’ve written before about uncertainty and the market volatility that often accompanies it, and we have experienced more than our share of both in 2020. We know that these conditions can be beneficial for long-term investors, though it’s often hard to see this over the short-term. Now, with the upcoming presidential election, new concerns about the impact on the stock market emerge among investors.

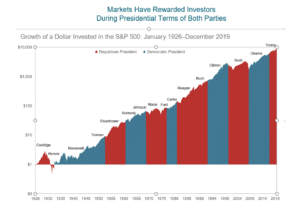

History is on the investor’s side

This presidential election season has done little to promote stability, including the prospect of a contested election. We may, however, gain some reassurance by looking at our history and the difficult times that we, and our economy, have weathered over the past century. It is natural to want to find a connection between who wins the White House and which way stocks markets will go. The reality is that returns since The Great Depression show that markets have no clear preference for either party. Stocks have trended upward across administrations from both parties. In only two terms (Franklin Roosevelt and George W. Bush) was the return of the S&P 500 negative over a presidential term.

Source: Dimensional Fund Advisors, 2020

So, while the candidates’ policy agendas are very different, markets are reacting to dozens of factors: the most significant being the Federal Reserve’s quantitative easing and the impact of low interest rates, as well as Congressional action on economic stimulus, oil prices, rising debt levels, consumer confidence, as well as the possible longer-term effects of the pandemic. The companies in the stock market are in business to thrive regardless of who wins the election and many have demonstrated that resilience in a variety of economic conditions.

We’re in this together

Through the pandemic, market swings, disruptions in employment, education and the devastation of the wildfires, this year has shown us the importance of being in this together. There is nothing this election will bring that we cannot navigate together. If history is a guide, the stock market will be higher at the end of the next presidential term.

This article is a reproduction of our client quarterly letter which we are sharing publicly during the pandemic to help provide insight and education for more people.

Wondering what tax policy changes may result from the election? Find out here.

The information provided herein is for informative and educational purposes only. The use of hyperlinks to third party websites is not an endorsement of the third party. Third party content has not been independently verified. To understand how this content may apply to you, please contact a financial advisor.