What is the yield curve, and what does it mean when it becomes inverted?

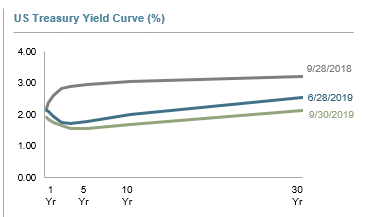

In the past several months, something unusual has happened to bond yields, something that had not happened since 2007: the yield curve inverted.

What is a yield curve?

What is the yield curve, and why is it noteworthy when it becomes inverted? Typically, an investor expects to be paid more to tie up his or her money for a longer period. When looking at bond yields (essentially their interest rates), a typical graph would show a constant upward slope, a higher return for longer maturities.

What is an inverted yield curve?

It’s unusual for interest rates to be higher on bonds that mature sooner than on those that mature later. When this happens, the curve is said to be “inverted.” The reason this gains such attention is that an inverted yield curve has predicted the last 7 recessions.

“Predicted” may be too strong a term. The last 5 recessions occurred an average of 18 months after the inversion, with the longest almost 3 years after. Some economists, including former Fed Chair Janet Yellen, believe the time period may be longer than average this time due to current monetary policy.

What does an inverted yield curve mean?

The inverted yield curve indicates a demand for safer investments and expectations for slower growth. This flight to safety may have resulted from a variety of factors, including the trade wars and the fact that bond interest rates are even lower internationally, with negative rates in Europe and Japan.

Recessions are inevitable, but the timing of them, even with the inverted yield curve as an indicator, is never certain. We know that recessions end, and we will return to normal economic growth patterns, but the timing of the recovery is uncertain as well.

“For my part, I know nothing with any certainty, but the sight of the stars makes me dream,” wrote Vincent Van Gogh. We are wise to embrace those things we can be certain of and avoid looking for certainty in economics and finance. Instead, keep to a well-thought-out and disciplined plan that takes into account the uncertainty of economic conditions.

The information provided herein is for informative and educational purposes only. The use of hyperlinks to third party websites is not an endorsement of the third party. Third party content has not been independently verified. To understand how this content may apply to you, please contact a financial advisor.