Recession outlook: consumer sentiment, inflation, and unemployment

The recession question

Will there be a recession? Are we in a recession already? The most pressing questions for investors for the second half of 2022 center around the prospect of a recession. To assess these matters, we must look to what Shakespeare called “the root of all heartache,” namely: expectations.

“Expectation is the root of all heartache.”―

In June, the Consumer Sentiment Index, based on monthly surveys of consumers’ attitudes about current and near-term expectations of the economy, fell to the lowest level since its inception in 1952. Worries about inflation were largely responsible for this pessimism. Consumer sentiment is important because it signals expectations for consumer spending, which comprises almost 70% of the economy. Fed Chair Jerome Powell noted recently, “It would be hard to watch anything more closely than we watch consumer spending.”

Recession vs. inflation

The Fed sees consumer expectations of persistent inflation as a greater risk to the economy than a recession, since low sentiment causes consumers to pull back on discretionary spending in anticipation of continued high costs of necessities like food and gas. It is now tasked with the challenge of trying to slow growth and control inflation enough to improve consumer sentiment, without overcorrecting to the point that we suffer a recession.

The latest GDP reports, showing negative GDP growth in both the first and (preliminarily) the second quarter indicate that a technical recession may have begun, but continued strong employment has led economists to hold out hope of staving off a full-fledged recession. Unemployment was a low 3.6% in June, for the fourth month in a row.

Good news for the stock market?

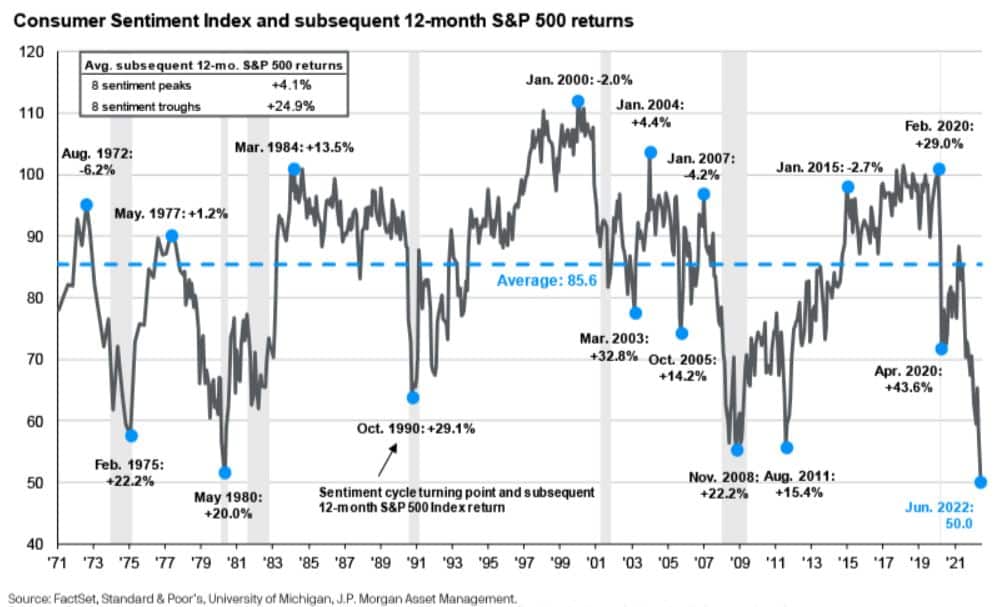

On the bright side, consumer pessimism may be a positive indicator for the stock markets. Historically, a low Consumer Sentiment Index bodes well for future stock prices (see chart below).

Since 1971, the average S&P return for the 12 months following a trough in consumer sentiment is +24.9%, while in the 12 months following a peak in sentiment, the average return was only 4.1%. Stock prices, as a leading indicator of the economy, take into account expected consumer spending and corporate plans for production and hiring, and begin to recover before the economy shows signs of improvement.

This article is a reposting of the Q2’22 quarterly letter we send to our clients. We feel it is important to share our perspective on the economy for everyone’s benefit.

The information provided herein is for informative and educational purposes only. The use of hyperlinks to third party websites is not an endorsement of the third party. Third party content has not been independently verified. To understand how this content may apply to you, please contact a financial advisor.