MAKE WORK OPTIONAL WITH

LIFE-CHANGING FINANCIAL ADVICE

LIFE-CHANGING FINANCIAL ADVICE

We know life can get complicated. Every success unlocks new opportunities, challenges, and questions. At The Advisory Group, we take a holistic approach to financial planning and investing that has one goal in mind: helping you create the life you want. Because we are true fiduciaries, you can rest assured our advice puts your financial future—and the future of those who depend on you—ahead of our own interests. With the right knowledge, strategies, and partner, you can make work optional. And that’s when success becomes freedom.

MAKE WORK OPTIONAL WITH LIFE-CHANGING FINANCIAL ADVICE

We know life can get complicated. Every success unlocks new opportunities, challenges, and questions. At The Advisory Group, we take a holistic approach to financial planning and investing that has one goal in mind: helping you create the life you want. Because we are true fiduciaries, you can rest assured our advice puts your financial future—and the future of those who depend on you—ahead of our own interests. With the right knowledge, strategies, and partner, you can make work optional. And that’s when success becomes freedom.

DO YOU WANT TO FIND CLARITY FOR WHAT’S NEXT?

You’ve worked hard to achieve success. And you strive for your life’s full potential and impact. Whether your next move is to pivot, pause, or pursue a new opportunity, you want to know your financial future is secure. Envision your next stage, with an experienced Wealth & Life Strategy advisor by your side.

Feel the freedom with our Personal Wealth Advisor services.

DO YOU LEAD A TEAM OF

EMPLOYEES THAT COUNT ON YOU?

You care about improving the lives and financial wellness of your employees and community. The right fiduciary support helps financial stewards accomplish more through high impact retirement plans and endowments. Serve others, protect yourself.

Discover our services designed to help you do just that.

DO YOU WANT TO FIND CLARITY FOR WHAT’S NEXT?

You’ve worked hard to achieve success. And you strive for your life’s full potential and impact. Whether your next move is to pivot, pause, or pursue a new opportunity, you want to know your financial future is secure. Envision your next stage, with an experienced Wealth & Life Strategy guide by your side.

Feel the freedom with our Personal Wealth services.

DO YOU LEAD A TEAM OF

EMPLOYEES THAT COUNT ON YOU?

You care about improving the lives and financial wellness of your employees and community. The right fiduciary support helps financial stewards accomplish more through high impact retirement plans and endowments. Serve others, protect yourself.

Discover our services designed to help you do just that.

Looking for an experienced financial advisor and guide?

For over 20 years, we’ve guided our clients through complex life-changing and smaller day-to-day decisions in the face of national and world economic events. Forward-focused, we combine our experience and expertise to help you make choices knowing the totality of your financial picture.

You benefit from a fellow Bay Area business—a tight-knit cohort of expert advisors—that offers boutique-quality financial planning and investment services. Plus, you gain the advantage of top-tier research only billion-dollar entities are normally privy to. The end result is having a team you can count on to anticipate what you need and free up your time to focus on what’s most important to you.

Looking for an experienced financial guide?

For over 20 years, we’ve guided our clients through complex life-changing and smaller day-to-day decisions in the face of national and world economic events. Forward-focused, we combine our experience and expertise to help you make choices knowing the totality of your financial picture.

You benefit from a fellow Bay Area business—a tight-knit cohort of expert advisors—that offers boutique-quality financial planning and investment services. Plus, you gain the advantage of top-tier research only billion-dollar entities are normally privy to. The end result is having a team you can count on to anticipate what you need and free up your time to focus on what’s most important to you.

STAY UPDATED

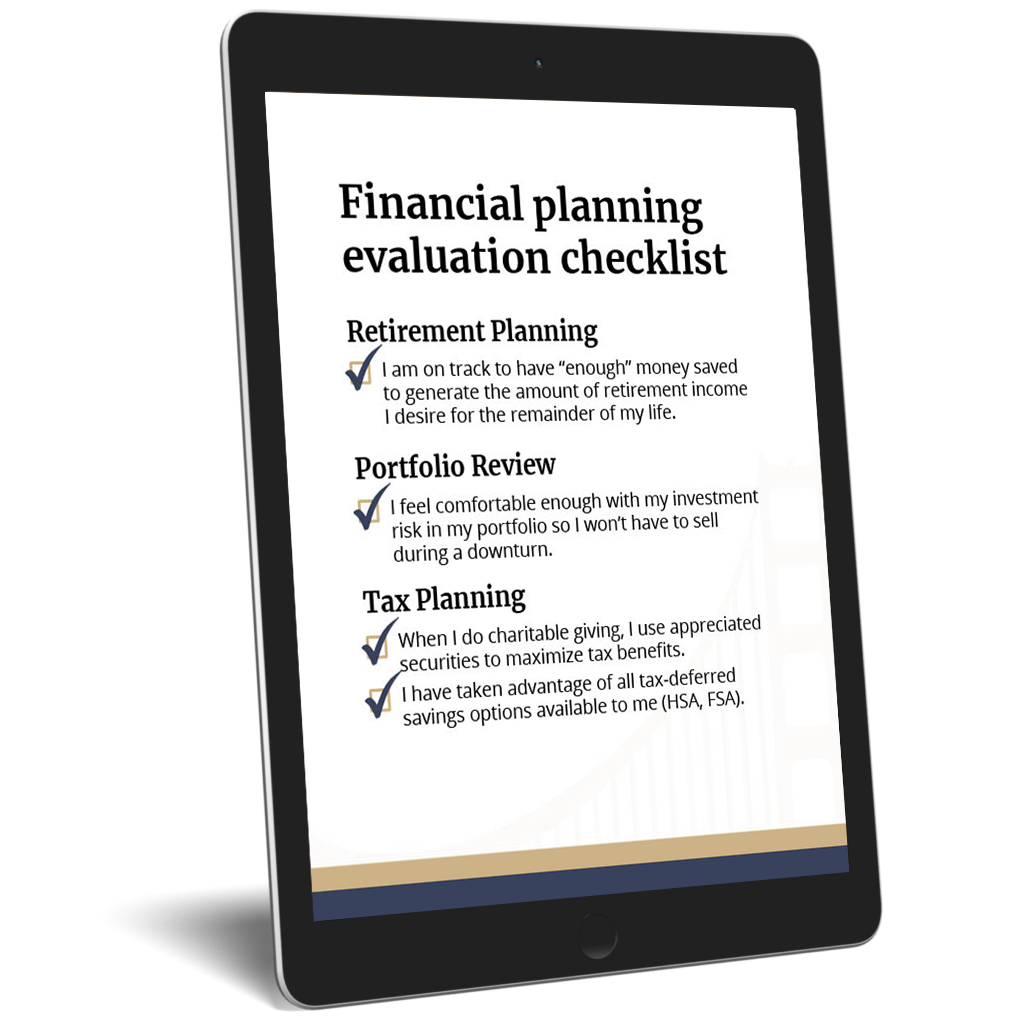

Whether you want to secure your personal wealth, improve the lives of your employees or elevate your impact in your community, we invite you to read the topics that matter most to you.

What the evolution of wealth management means for Generation X and retirement

A recent financial literacy study from Investopedia shows Generation X (or Gen X) is invested in—and concerned about—retirement. Currently between 44 and 59 years old in 2024, Gen Xers recognize that it’s time to [Read More]

To lower your tax bill, avoid these 9 common tax-planning mistakes

If you think your tax bill is too high, you’re not alone. Two-thirds of Americans feel like they spend too much on federal taxes—and that’s before tacking on property or state taxes. What if [Read More]

Mastering Longevity: Financial Planning Strategies for Your Health and Your Wealth

The so-called “sandwich generation” is squished between their aging parents and adult children, like a piece of lettuce. That’s how some are now referring to Gen Xers (born roughly between 1965 and 1980). Between [Read More]

What really matters in the economy and markets from the fourth quarter of 2023

News vs. noise Stock and bond markets came out better than expected in 2023 despite rate hikes, wars and collapsed banks, the chance of recession is dropping but still exists, markets may be more [Read More]